By Roy KIM Jia Liang and KB Kee

China Environment (SES: 50U, Bloomberg: CENV SP) FY2014:

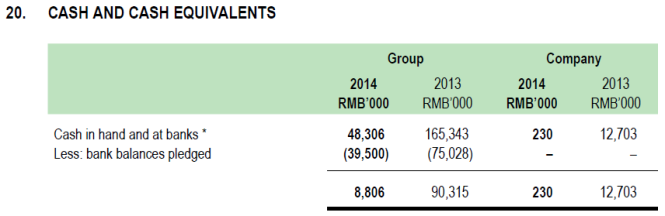

- Receivables past due more than 90 days exploded from RMB90m in FY13 (17% of sales, 12% of current assets) to RMB306m (52.4% of sales, 34% of current assets) in FY14, with no provision for impairment. Cash and Cash Equivalents down from RMB90.3m in FY13 to RMB8.8m in FY14.

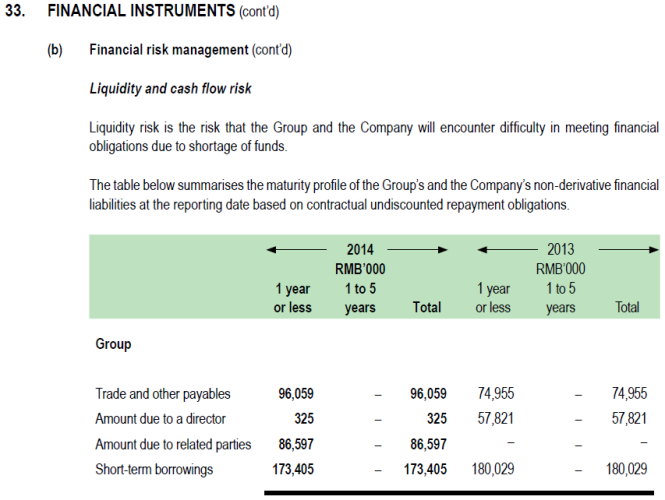

- Notice how the “trade receivables not past due” (“deposits with bank”?) amounting to RMB297m eerily approximates the sum of Amount due to related parties RMB86.6m, Short-term borrowings RMB173.4m and Bank balances pledged RMB39.5m. Are these circular money-go-round transactions in money pledged to give loan guarantees and loans to related-parties?

- Overall: Further doubts are cast on the propriety and reliability of receivables and revenue figures with the potential risk of undisclosed related-party transactions severely misrepresenting the financial status of the company.

- Chronology of events:

- Feb 10, 2015: Part 1 of article series on China Environment highlighting accounting and governance issues. Part 2 on Feb 17, Part 3 on Feb 23.

- Feb 16, 2015: CFO CT Chiar replied using the moniker “Sadme” and a personal email (zzh721@yahoo.com).

- Feb 27, 2015: Unaudited FY14 financial results announcement with 4Q14 sales and profit witnessing a sudden plunge, corresponding with a sharp decrease in cash and a sudden increase in “Other Receivables (Unsecured, Interest-Free Advances to Unidentified Mysterious Subcontractor With No Provision for Impairment to Mitigate Default or Non-Repayment Risk)”.

- Mar 9, 2015: Open Letter to SGX/MAS: Reply to CFO of SGX-Listed China Environment (CENV SP) on report “Potential Accounting Tunneling Fraud at China Environment?” – Address the accounting and governance concerns in an SGX/MAS announcement.

- Apr 2, 2015: Auditor Emphasis of Matter and the partial repayment (disgorging?) of cash taken out from the listco. Read: (1) China Environment: Auditor Emphasis of Matter raises more questions on potential accounting tunneling risk, (2) Does Auditor Explanatory Language in Unqualified Audit Reports Indicate Increased Financial Misstatement Risk? “Emphasis of matter” language predicts restatements,

- Apr 13, 2015: Receivables past due more than 90 days exploded.